Maximizing Tax Benefits with Qualified Opportunity Zones

- Mike C.

- Oct 8, 2025

- 3 min read

Investing in qualified opportunity zones offers a unique chance to reduce tax liabilities while supporting economic growth in underserved areas. These zones provide powerful tax incentives designed to encourage long-term investments. But how can you maximize these opportunity zone tax benefits effectively? This guide breaks down the essentials, practical strategies, and key differences from other tax deferral options to help you make informed decisions.

Understanding Opportunity Zone Tax Benefits

Opportunity zones were created to stimulate investment in economically distressed communities by offering tax advantages to investors. The primary benefits include:

Deferral of capital gains tax on the initial investment until 2026 or the date of sale, whichever comes first.

Reduction of the deferred gain if the investment is held for at least 5 or 7 years.

Exclusion of gains on the new investment if held for at least 10 years.

These incentives encourage investors to commit capital for the long term, which can lead to substantial tax savings and community revitalization.

How the Tax Benefits Work in Practice

Imagine you sold an asset and realized a $500,000 capital gain. By reinvesting that gain into an opportunity fund that invests in opportunity zones, you can defer paying taxes on that $500,000 until 2026. If you hold the investment for 5 years, you get a 10% exclusion on the deferred gain, reducing your taxable amount to $450,000. Hold it for 7 years, and the exclusion increases to 15%. Finally, if you keep the investment for 10 years, any appreciation on the new investment is tax-free.

This structure rewards patience and long-term commitment, making it ideal for investors looking to balance tax efficiency with impact.

Strategic Approaches to Maximize Opportunity Zone Tax Benefits

To fully leverage these tax benefits, consider the following strategies:

Identify the Right Opportunity Fund: Not all funds are created equal. Look for funds with a clear plan, strong management, and a focus on projects that align with your investment goals. For example, funds investing in bitcoin mining operations within opportunity zones can offer both growth potential and community impact.

Time Your Investment Carefully: The clock starts ticking when you invest your capital gains. To maximize the 10-year benefits, invest as early as possible. Delaying reduces the time you can benefit from the stepped-up exclusions.

Diversify Within Opportunity Zones: Spread your investment across different projects or sectors within opportunity zones to mitigate risk. This approach can balance high-growth ventures with stable, income-generating assets.

Plan for Tax Timing: Since the deferred gain is taxed in 2026, plan your strategy accordingly. Holding 10 years can eliminate capital gains on the new investment, but you must be prepared for the deferred gain tax event.

Consult Tax Professionals: Opportunity zone investments involve complex rules. Work with tax advisors who understand the nuances to ensure compliance and optimize your tax position.

By following these steps, you can enhance your returns while contributing to meaningful economic development.

Practical Tips for Accredited and Impact Investors

If you qualify as an accredited or impact investor, opportunity zones offer a compelling way to align financial returns with social impact. Here are some actionable tips:

Focus on Impact-Driven Projects: Seek funds that prioritize community development, job creation, and sustainable growth. This aligns with the broader goals of opportunity zones and can enhance your investment’s legacy.

Evaluate Fund Track Records: Look for funds with proven success in opportunity zones. Past performance, management expertise, and transparent reporting are critical.

Leverage Technology and Innovation: Consider investments in emerging sectors like bitcoin mining within opportunity zones. These projects can offer high growth potential while revitalizing local economies.

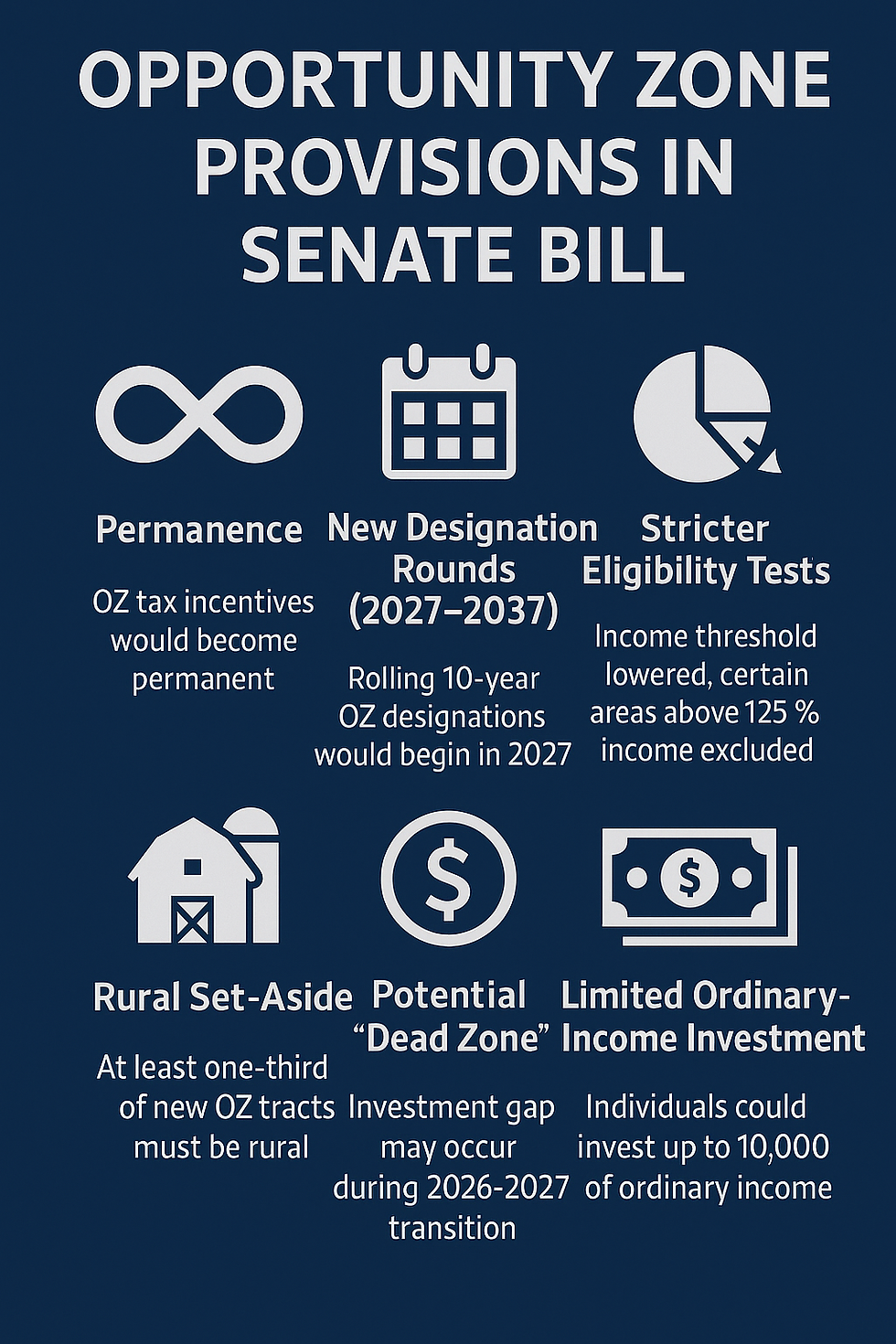

Monitor Regulatory Changes: Opportunity zone regulations may evolve. Stay informed to adapt your strategy and maintain compliance.

Use Opportunity Zones as Part of a Diversified Portfolio: While attractive, opportunity zone investments should complement other assets to balance risk and return.

By integrating these tips, investors can maximize both financial and social returns.

Building a Legacy Through Opportunity Zone Investments

Investing in opportunity zones is more than a tax strategy - it’s a chance to leave a lasting impact. Projects in these zones can transform communities, create jobs, and foster innovation. For example, SatoshOZ is pioneering bitcoin mining operations within opportunity zones, combining cutting-edge technology with economic revitalization.

This dual focus on profit and purpose resonates with people who want to make a difference while optimizing their tax position. By choosing the right projects and holding investments long-term, you can build a legacy that benefits both your portfolio and society.

Ready to explore opportunity zone investments? Start by researching funds, consulting experts, and aligning your goals with projects that deliver measurable impact.

Maximize your tax benefits and contribute to community growth by investing wisely in opportunity zones. The potential rewards - both financial and social - are significant when you approach these investments strategically and with a long-term vision.