🚨 Big Changes Ahead for Opportunity Zones: Senate Bill Brings New Rules, Rural Boosts, and Investor Certainty

- Mike C.

- Jun 17, 2025

- 2 min read

June 17, 2025 | By Mike C. | Y’all Street Insights

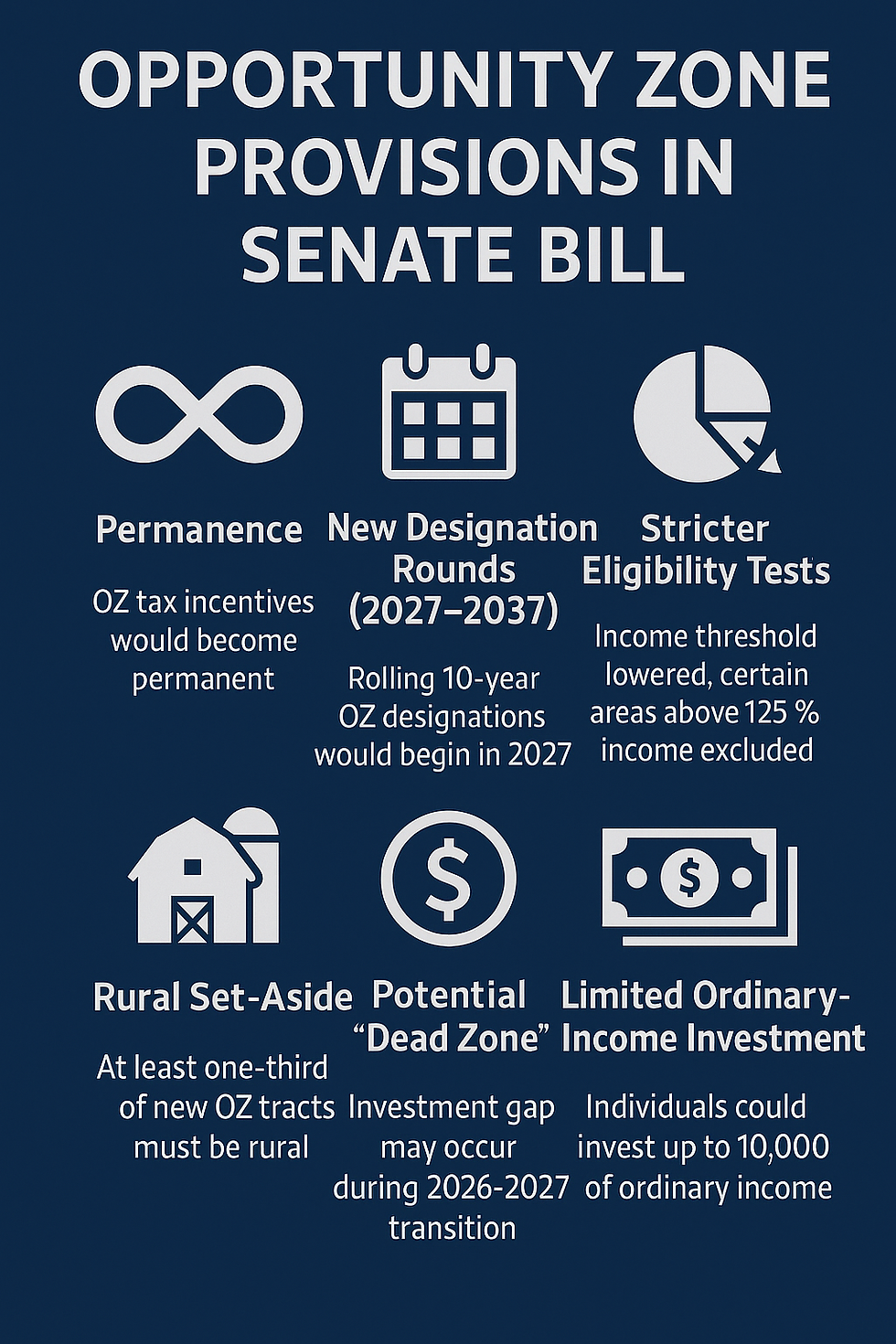

The Senate just dropped a tax bombshell—and Opportunity Zones (OZs) are squarely in the blast radius. In a major shift tucked into the Senate Finance Committee’s latest version of the budget reconciliation bill, the future of OZ investing is being rewritten. Permanence? Check. Rural incentives? Bigger than ever. New zones coming? You bet—just not until 2027.

Here’s what you need to know.

✅ 1. Opportunity Zones Made Permanent

The most important takeaway: Opportunity Zone incentives would no longer sunset. That’s a game-changer for investors who’ve been on the fence about deploying capital into QOFs (Qualified Opportunity Funds). Permanence means confidence. And confidence means capital can finally settle in for the long haul.

🚜 2. Rural Tracts Get a Serious Sweetener

In a move tailor-made for flyover states and underserved towns, the bill requires that at least one-third of new OZ tracts be rural. But here’s the kicker:

Investors in rural OZs get a 30% basis step-up after 5 years.

That’s triple the 10% benefit available in non-rural tracts.

Translation: small-town investments just got a big-city incentive.

📅 3. The Calendar Shift: A Gap Year Looms

Current OZ designations expire December 31, 2026.

New ones don’t kick in until January 1, 2027.

This sets up a potential “dead zone” in 2026 where no new OZ investments can be made. For fund managers and developers, it’s time to either double down now or plan for a gap-year fundraising drought.

📉 4. Stricter Eligibility—No More Gentrified Zones

The definition of who qualifies as “distressed” is getting tighter:

Areas must be under 70% of median family income (down from 80%).

Wealthier census tracts with high poverty rates will be excluded.

That means fewer gentrifying neighborhoods getting OZ perks—and more focus on areas that truly need revitalization.

💵 5. Limited Ordinary-Income Investment—Mostly Symbolic

The Senate bill allows individuals to invest up to $10,000 of ordinary income (not just capital gains) into OZs. But for serious allocators, this provision is more political messaging than practical reform.

📊 6. Transparency Is Coming (Eventually)

While this bill doesn’t yet include the full suite of reporting reforms, the Senate signaled support for mandatory QOF disclosures, including:

NAICS codes

Housing units built

Job creation data

Due to reconciliation rules, this part may arrive in standalone legislation—but it’s coming.

🧠 Final Take: A New OZ Era Is Coming

This bill doesn’t just tweak Opportunity Zones. It retools them—and repositions them for a broader future, with a tilt toward permanent policy, rural revitalization, and real impact.

For investors, the message is clear: 2025 is the time to act—before the 2026 gap, and before the game changes again.

Stay tuned, stay strategic, and as always—invest where Main Street meets Wall Street.